Preventing fraud

•Power of attorney

•Estate settlement

•Financial caregiving

As caregivers for aging parents, that sometimes means taking on the financial caregiving, which can include everything to paying their bills, fraud prevention, or estate planning. While it can be really overwhelming to help your aging parents manage their finances and plan for the future, we have some recommendations and community advice to help you on this journey.

What is the community saying?

Questions & Comments

Resources

American Bankers Association

Staff Pick

Staff Pick

Uncared For

Staff Pick

Sandwich Club's recommended products

We only recommend items we've personally used, tested, or carefully vetted through caregiver recommendations.

Getting Your Parent’s Financial House in Order

It can be really overwhelming to help your aging parents manage their finances, especially if they haven’t involved you before. From full-on financial planning to organizing key documents, these services make it easier to have hard conversations around money, honor our loved ones' wishes, and keep their finances secure and streamlined.

Simplify estate planning

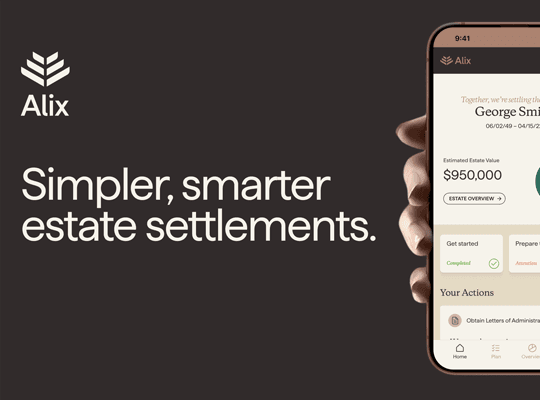

Alix

Save time and lighten the burden of estate planning by letting Alix take the lead.

Staff Pick

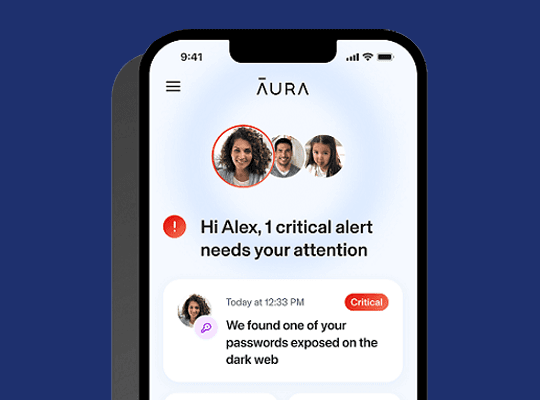

Prevent identity theft and fraud

Aura

Protect your loved one against scams and fraud that could jeopardize their finances.

Member Pick

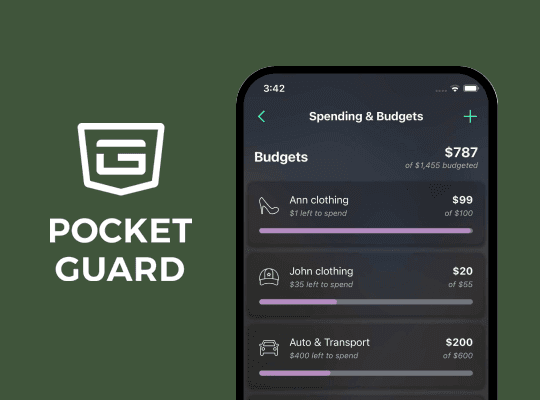

Track spending with ease

PocketGuard

An easy to use app that tracks spending across accounts for help budgeting and paying off debt.

Staff Pick

I find using an app for Caregiving role and a financial app together has been best for me to include scheduled tasks and responsibilities such as financials while allowing me to have access and viewing to the financial accounts and other financial documents.

Jenny Y.

Resources

American Bankers Association

Staff Pick

Staff Pick

Uncared For

Staff Pick

Member questions on this topic

Ask your own question about financial planning for older adults